Last November, the club announced that the Glazers, who have owned the club since 2005, were starting a process to look at “strategic alternatives” that could include a full sale, a partial sale or borrowing more money to fund much-needed infrastructure improvements. Maybe I’ll include a provision in the offering document allowing me to fine any PFT shareholder up to $500,000 for criticizing PFT.Man United staying under Glazer control is still very possible – this is why And if I get fined $500,000, I’ll just sell some non-stock stock in PFT for the purposes of raising the money. The devil on one shoulder is currently battling with the angel on the other. On the other hand, it’s in the document, and it’s apparently there for a reason. On one hand, it’s a stupid boilerplate provision that will never actually be enforced. It also would be fun to see them try to collect the money. It would be fun (or maybe another word) to chronicle the efforts of the Commissioner to potentially fining me up to $500,000 for criticizing Roger Goodell or Jeff Pash or any specific owners or teams or officials or coaches or whatever. “If the Commissioner of the NFL (the ‘Commissioner’) decides that a shareholder of an NFL member club has been guilty of conduct detrimental to the welfare of the NFL then, among other things, the Commissioner has the authority to fine such shareholder up to $500,000 and/or require such shareholder to sell his or her stock.” publicly criticizing any NFL member club or its management, employees or coaches or any football official employed by the NFL,” the offering document explains.

“The NFL Rules prohibit conduct by shareholders of NFL member clubs that is detrimental to the NFL, including, among other things. PFT for spending $300 (plus a $35 “handling fee”) for a piece of paper to be framed on the wall in the PFT barn. The clause that caused me to think twice about buying a share - even though I’m ready to do so, after securing all appropriate approvals from Mrs. “As noted above, it is virtually impossible for anyone to recoup the amount initially paid to acquire Common Stock due, among other things, to transfer restrictions and Common Stock repurchase rights of the Corporation.”Īnd even though the shares cost $300 each, they are “involuntarily redeemable” at $0.025 per share, if the Board of Directors learns that the shareholder cannot be located after at least five years since last contact with the corporation.īut here’s the kicker. “As was the case in connection with earlier offerings of Common Stock, purchasers of Common Stock will not truly participate in the Corporation’s economic fortunes,” the offering document explains. It’s a donation, with very little benefit or influence in return. So it’s really, truly, absolutely not stock. Also, "he corporation believes offerees and purchasers of common stock will not receive the protection of federal, state, or international securities laws with respect to the offering of common stock.” The offering document also explains that it hasn’t been “approved or recommended by the” the Securities and Exchange Commission. Particularly in light of the transfer restrictions and redemption rights of the corporation described in this offering document, it is virtually impossible for anyone to realize a profit on a purchase of common stock or even to recoup the amount initially paid to acquire such common stock.”

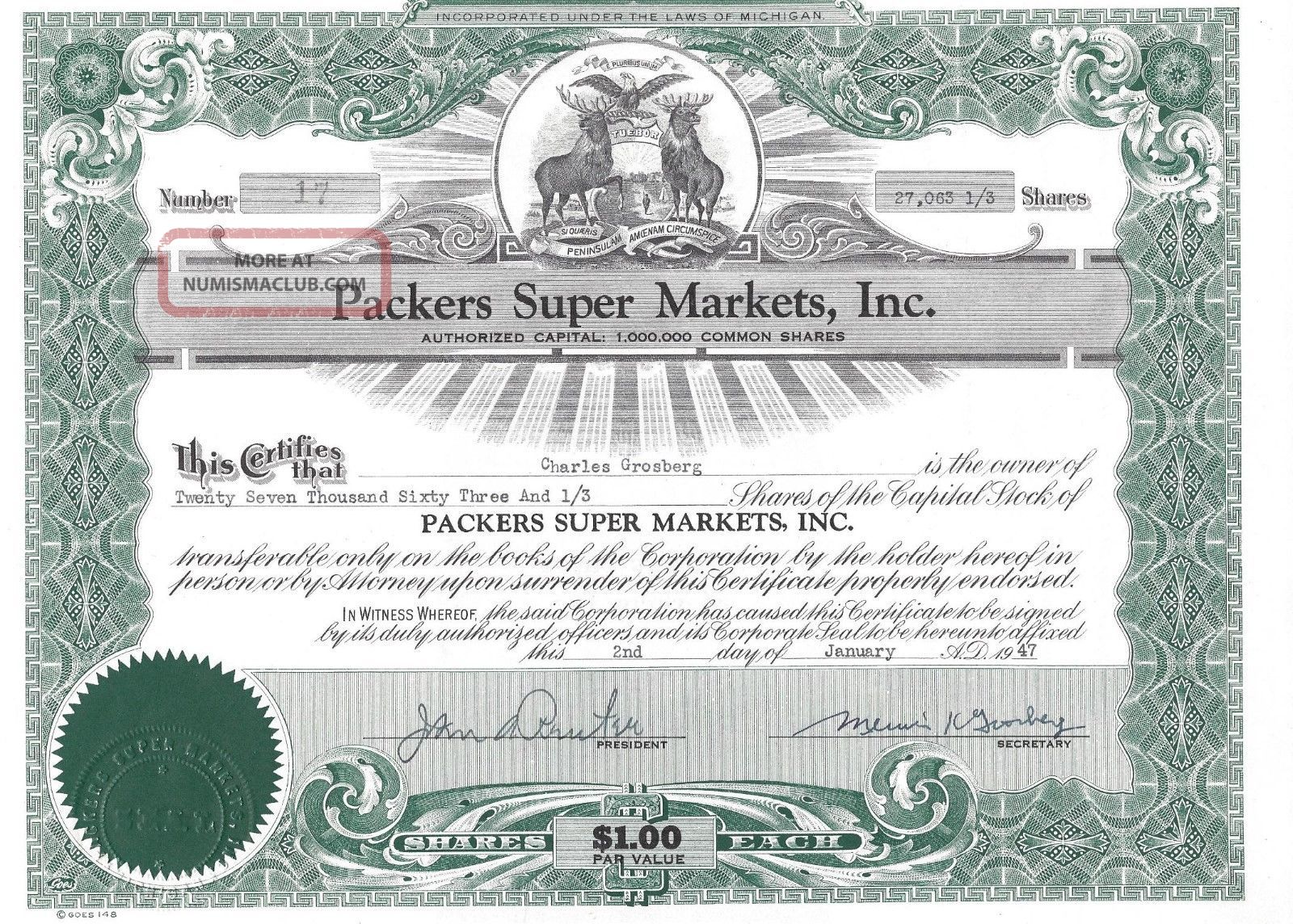

“Purchasers should not purchase common stock with the purpose of making a profit. “Common stock does not constitute an investment in ‘stock’ in the common sense of the term,” the offering document explains. (We’ve opted for normal letters, since using all caps is basically screaming into someone’s eyeballs.) And, as the offering document reveals, it also becomes a potential source of very real liability for anyone who dares criticize the NFL or its member teams.īefore delving into the nuances of fine print that will induce potential puckering for people in the media who are tempted to buy a share, it’s important to point out the stuff that the Packers placed in all caps. Which means that, if you own one share, you own 0.000019 percent of the company.īut it’s not really stock. With the latest offering, the total amount of Packers shares will grow to 5.3095 million. Which should buy some really nice video boards and allow for the floors of the concourse to be coated in diamonds. If all 300,000 shares are sold at $300 each, they’ll raise $90 million. This time around, the goal is to raise money for improvements to Lambeau Field, “including by installing HD video boards and making concourse improvements.” For the sixth time in franchise history, the Packers are selling stock.

0 kommentar(er)

0 kommentar(er)